Linear depreciation calculator

Enter the purchase price of a business asset the likely sales price and how long you will use the asset to compute the annual rate of. Select the currency from the drop-down list optional Enter the.

Straight Line Depreciation Calculator Double Entry Bookkeeping

The calculator also estimates the first year and the total vehicle depreciation.

. To calculate straight-line depreciation. For example if you have an asset. Find the assets book value by subtracting its.

In the non-linear method the accrued amount per month for the depreciation asset is. This simple depreciation calculator helps in calculating depreciation of an asset over a specified number of years using different depreciation methods. This limit is reduced by the amount by which the cost of.

The algorithm behind this straight line depreciation calculator uses the SLN formula as it is. If the depreciation pattern. When an asset loses value by an annual percentage it is known as Declining Balance Depreciation.

This depreciation calculator is for calculating the depreciation schedule of an asset. By using the straight-line depreciation calculator by Vyapar you can get the fixed monthly depreciation cost of an asset. Based on Excel formulas for DB costsalvagelifeperiodmonth will calculate depreciation at a fixed rate as a function of SalvageCost 1Life Variable Declining Balance Depreciation.

Straight Line Asset Depreciation Calculator. Lets take an asset which is worth 10000 and. For example if an asset is worth 10000 and it depreciates to.

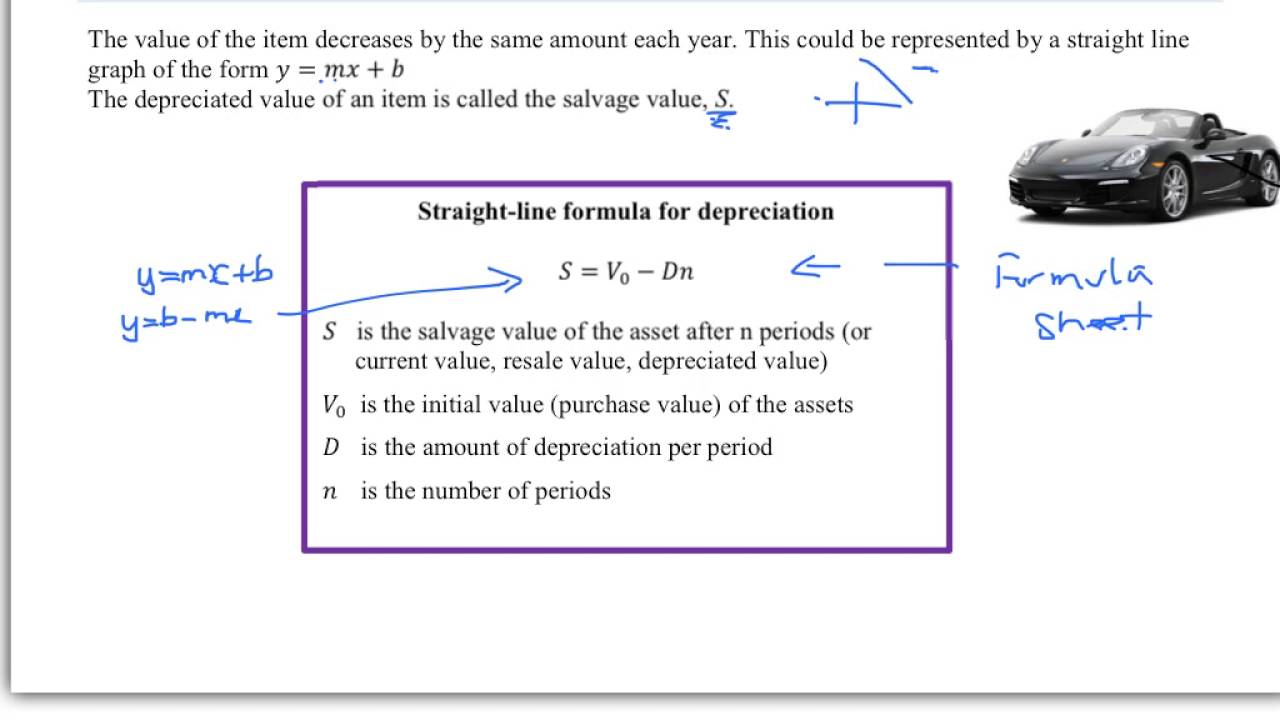

When the value of an asset drops at a set rate over time it is known as straight line depreciation. Percentage Declining Balance Depreciation Calculator. For tax years beginning in 2021 the maximum section 179 expense deduction is 1050000.

All you need to do is. Therefore you can calculate depreciation for a computer by using the linear method. Section 179 deduction dollar limits.

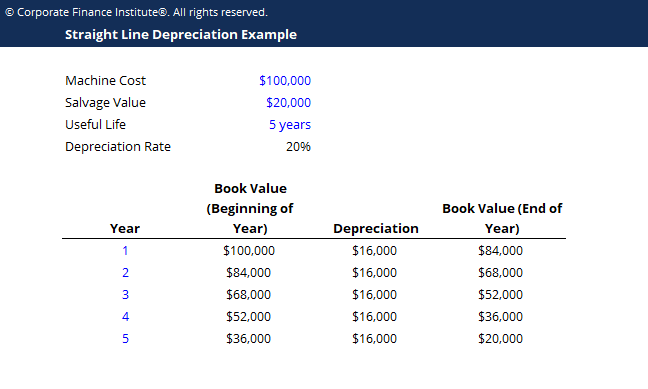

Straight Line Depreciation Calculator. Straight line depreciation is where an asset loses value equally over a period of time. Straight Line Depreciation Calculator.

It is fairly simple to use. First one can choose the straight line method of. If the depreciation pattern is accelerated evaluate whether a fixed depreciation rate can be used resulting in use of an exponential curve as described in Section 61.

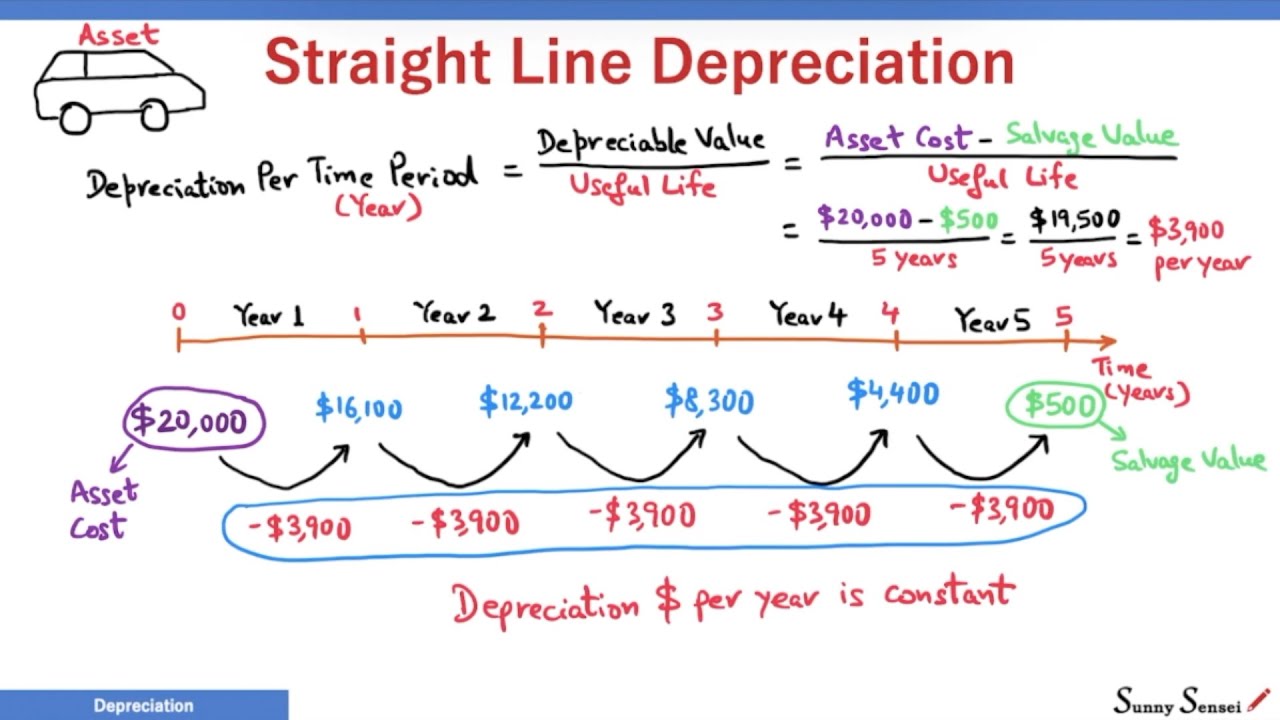

The amount of value an asset will lose in a particular period of time. In the simplest terms depreciation is the decrease in valueImagine that you bought a car for 20000. The calculator allows you to use.

To get the mid-month depreciation simply divide the monthly. The MACRS Depreciation Calculator uses the following basic formula. After a few years the vehicle is not what it used to be in the.

It provides a couple different methods of depreciation.

Straight Line Depreciation Schedule Calculator Double Entry Bookkeeping

Method To Get Straight Line Depreciation Formula Bench Accounting

Straight Line Depreciation Template Download Free Excel Template

What Is Straight Line Depreciation Method Pmp Exam Youtube

Depreciation Methods Principlesofaccounting Com

Excel Straight Line Depreciation Calculator Spreadsheet Free Download

Straight Line Depreciation Formula And Calculator

Macrs Depreciation Calculator With Formula Nerd Counter

Straight Line Depreciation Formula And Calculator

Straight Line Depreciation Formula Guide To Calculate Depreciation

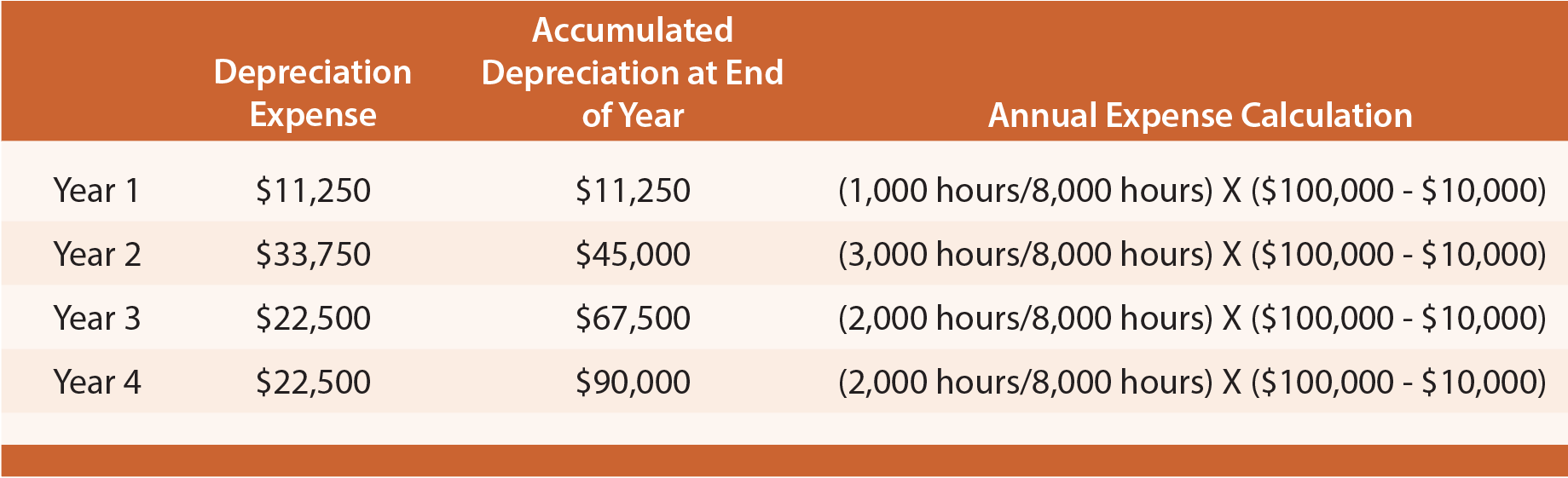

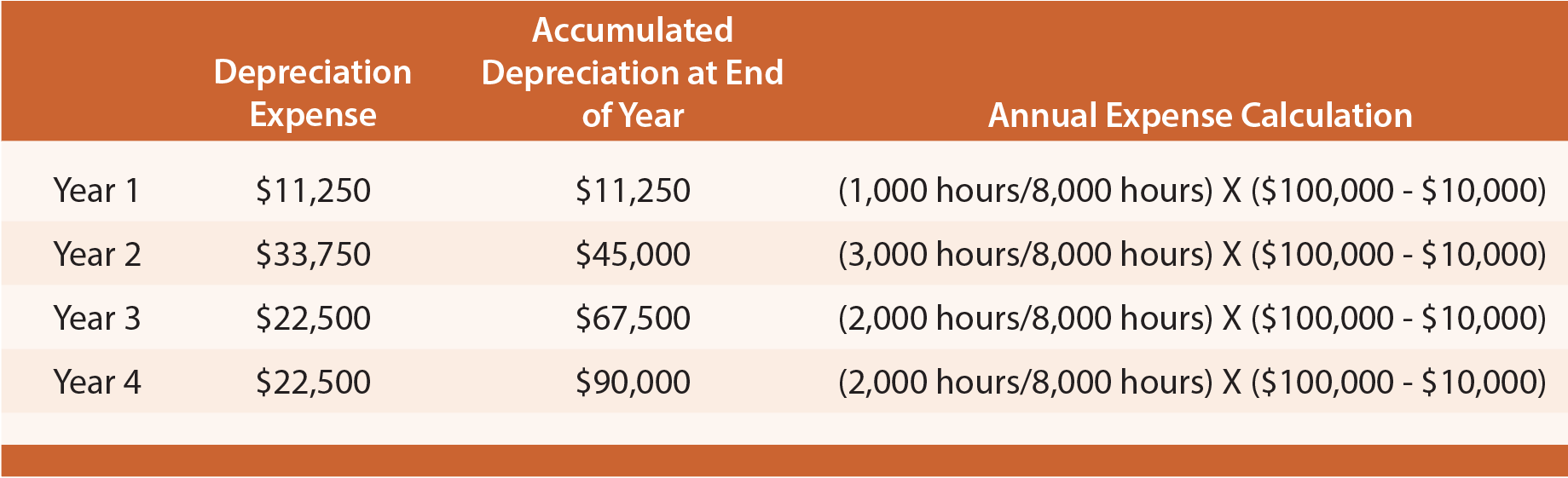

Depreciation Formula Calculate Depreciation Expense

Depreciation Expense Double Entry Bookkeeping

Depreciation Formula Examples With Excel Template

Linear Automobile Depreciation Ppt Video Online Download

Straight Line Depreciation Youtube

Straight Line Depreciation Double Entry Bookkeeping

1 Free Straight Line Depreciation Calculator Embroker