Online depreciation calculator

The necessary amount expended to get an asset ready for its intended use. Units of production is a differently worded version of our activity depreciation calculator.

Free Depreciation Calculator Online 2 Free Calculations

You will probably agree that selling it for 20000 again would not be especially fair you have some sort of a gut feeling that it is worth much less now.

. The Washington Brown a property depreciation calculator is unique because it enables property investors to estimate the depreciation by simply inputting a purchase price. Web You may set the number of decimal places in the online calculator. Where A is the value of the car after n years D is the depreciation amount P is the purchase amount R is the percentage rate of depreciation per annum n is the number of years after the purchase.

D i C R i. Cut-and-paste the text you want to test into the box below then click Calculate. Getting answers to your tax questions.

All you have to do is chat with one of our online agents and get your assignment taken care of with the little remaining time. Web Use this calculator to calculate depreciation based on level of production for each period. Web Course help online is here to help with such urgent orders.

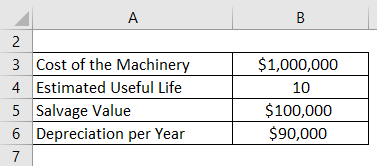

Use this calculator to calculate an accelerated depreciation of an asset for a specified period. Wanna calculate your net worth at 3 in the morning or calculate your one rep weight lifting max after your afternoon workout or even calculate how much tile you need before starting your weekend bathroom remodeling project. It has a useful life of 10 years and a salvage value of 100000 at the end of its useful life.

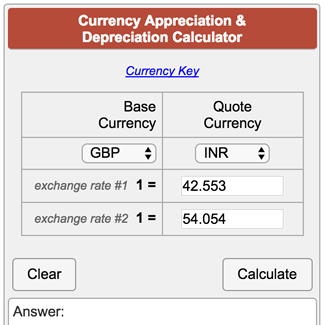

In terms of accounting depreciation is a systematic reduction of the cost of any fixed asset till it becomes useless or in other words its value becomes negligible. The percentage change of INR relative to GBP is V 1 - V 2V 2 100 42553 - 5405454054 100. For instance a widget-making machine is said to depreciate when it produces fewer widgets one year compared to the year before it or a car is said to depreciate in value after a fender bender or the discovery of a faulty.

A depreciation factor of 200 of straight line depreciation or 2 is most commonly called the Double Declining Balance MethodUse this calculator for example for depreciation rates entered as 15 for 150 175 for 175 2 for 200 3 for 300 etc. Web Calculate Anything Anytime. C is the original purchase price or basis of an asset.

Conceptually depreciation is the reduction in the value of an asset over time due to elements such as wear and tear. Web Figure all other equipment on a depreciation schedule - five years is typical check with your accountant - perform similar math and add this to your total from above. Water Intake Calculator new.

We base our estimate on the first 3 year depreciation curve age of vehicle at purchase and annual mileage to calculate rates of depreciation at other points in time. Above is the best source of help for the tax code. Estimate the cost of new equipment with new capabilities faster longer lenses lighting different camera formats new audio devices etc you plan to add over the next five.

The calculation is based on the Modified Accelerated Cost Recovery method as described in Chapter 4 of IRS Publication 946 - How To Depreciate Property. Web Calculate depreciation of an asset using the double declining balance method and create a depreciation schedule. Web A depreciation calculator is merely an accounting tool that helps investors save money by claiming the wear and tear of a property on their tax return.

Where D i is the depreciation in year i. 26072012 Create Your Savings Plan Online New Savings Calculator Aims To Remove The Guesswork When Deciding How Much To Put Away For Future Goals. The first item under line 5a in Worksheet 2 is a business depreciation item.

Calculator for depreciation at a declining balance factor of 2 200 of straight line. Web The second calculator helps you figure out what vehicle price you can afford for a given monthly loan payment. We can take care of your urgent order in.

Web This Flesch Kincaid Calculator can be used to show how readable your text is by providing a Flesch Readability Ease score and the Flesch-Kincaid Grade Level score. The Sales Tax Deduction Calculator IRSgovSalesTax figures the amount you can claim if you itemize deductions on Schedule A Form 1040. 30000 as depreciation in this case next year wdv will be.

We have qualified academic writers who will work on your agent assignment to develop a high quality paper for you. This will give you the texts readability scores. Web This calculator will calculate the rate and expense amount for personal or real property for a given year.

Web Car Depreciation By Make and Model Calculator Find the depreciation of your car by selecting your make and model. You can then calculate the depreciation at any stage of your ownership. Use our depreciation calculator to estimate the depreciation of a vehicle at any point of its lifetime.

D P - A. Web Depreciation can be claimed at lower rate as per income tax act. Any figure for this item is 100 a business figure.

Web 100 rule for depreciation. TaxAdda Private Limited CIN - U93000RJ2019PTC067547 GSTIN - 08AAHCT6764E1Z1. Car Depreciation Calculator new.

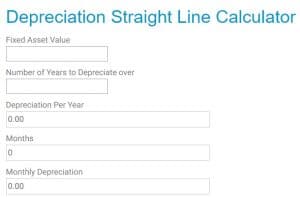

The average car depreciation rate is 14. If you have a question about the calculator and what it does or does not support feel free to ask it in the comment section on this page. Inputs Asset Cost the original value of your asset or the depreciable cost.

Web Depreciation Calculator as per Companies Act 2013. What is Depreciation in Accounting. For eg if an asset is of Rs.

Web A positive change is appreciation and a negative change is depreciation. The MACRS depreciation calculator adheres to US income tax code as found in IRS Publication 946 opens in new tab. Web Accumulated Depreciation Formula Example 1.

Web The Car Depreciation Calculator uses the following formulae. Web In the simplest terms depreciation is the decrease in valueImagine that you bought a car for 20000. But for the next year your wdv will be considered as reduced by the percentage of depreciation prescribed.

Web Further you can use the Vyapar depreciation calculator online to confirm the depreciation value of your asset. R i is the depreciation rate for year i depends on the assets cost recovery period. After a few years the vehicle is not what it used to be in the beginning.

Web The MACRS Depreciation Calculator uses the following basic formula. If you trade in every few years then depreciation is something to. We are so committed to providing online calculators to calculate answers to.

Includes formulas example depreciation schedule and. Plus the calculator also gives you the option to include a year-by-year depreciation schedule in the. 2018 or current year - 2012 year make of vehicle 6 1 year to account for first year of offer 7 total years of depreciation.

For example calculating between GBP and INR. A couple years old can still provide you with a reliable vehicle for thousands less while letting someone else take the depreciation hit. If a year ago 1 GBP 42553 INR and today 1 GBP 54054 INR we have V 1 42553 and V 2 54054.

Company ABC bought machinery worth 1000000 which is a fixed asset for the business. 7th year depreciation amount 57 according to current schedule depreciation. Web MACRS Depreciation Calculator Help.

1 lakh and 80 depreciation is prescribed for the asset and you charge only rs. Web Car Depreciation Calculator. By default there are only two decimal places.

A P 1 - R100 n.

Straight Line Depreciation Calculator Double Entry Bookkeeping

Macrs Depreciation Calculator Straight Line Double Declining

Accumulated Depreciation Formula Calculator With Excel Template

1 Free Straight Line Depreciation Calculator Embroker

Reducing Balance Depreciation Calculator Double Entry Bookkeeping

Macrs Depreciation Calculator With Formula Nerd Counter

Macrs Depreciation Calculator Irs Publication 946

Depreciation Calculator Depreciation Of An Asset Car Property

Depreciation Calculator

Sum Of Years Depreciation Calculator Double Entry Bookkeeping

Currency Appreciation And Depreciation Calculator

Double Declining Balance Depreciation Calculator

Double Declining Balance Depreciation Calculator Double Entry Bookkeeping

Car Depreciation Calculator

Free Depreciation Calculator Online 2 Free Calculations

Accumulated Depreciation Formula Calculator With Excel Template

Free Depreciation Calculator Online 2 Free Calculations